Best overall: Charles Schwab

Charles Schwab |

| Editor’s rating | 4.79 out of 5 |

| Trade Comission Fees | None |

| Account minimum | None |

| Consider it if… | You want a wide range of account types; easy-to-use apps and web interface |

Why Charles Schwab made our list:

Charles Schwab’s Schwab Mobile is a strong all-around choice for stock traders. It comes with no account minimums and no recurring fees. You can choose between just about any type of investment account you would want and most types of investments. And for stock trades, the app is well-rounded for both beginners and experts. Schwab also offers a no-fee automated adviser, Schwab Intelligent Portfolios.

The mobile app makes it easy to view your accounts, positions, and balances. You can view market indices and news, research stocks, and enter an array of trade types from the app. A new feature, the Schwab Assistant, gives you voice control to make trades, get quotes, set alerts, and get answers to questions about investments.

Users also have access to the more advanced StreetSmart Mobile. It works well but doesn’t rate among the very best for the most active traders. But Schwab now owns TD Ameritrade and thinkorswim, which is an industry leader for active traders. More on that in the next section.

End of the Game

The game ends at the end of the final Movement Phase. Any cards leftover in the Market Deck will not be used in this game.

Game End Steps:

All players reveal how many shares of stock they own for each company to determine the majority shareholders. A majority shareholder is the player with the most stock in any company.

Note: Shares in player’s Split Portfolios count as double when determining majority shareholders.

The majority shareholders of each company receive a bonus of $10,000. If there is a tie, all tied players receive $5,000.

Each player then sells back their shares at a price equal to the final value of the stock.

Note: Again, any shares in players’ Split Portfolios count as double.

Add up each player’s Currency Cards. The player with the most money, and thus the greatest net worth, wins.

Continue Reading

Supply Phase

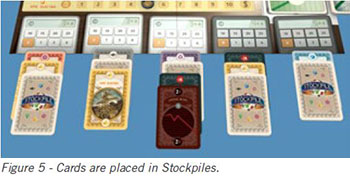

During the Supply Phase, players place cards into Stockpiles. These cards may be shares of company stock, trading fees, or action cards. Stockpiles represent the market supply, and they are bid on and obtained during the Demand Phase.

Supply Phase Steps

Flip one card from the Market Deck face-up to start building each Stockpile. Stockpiles are formed under the calculators at the bottom of the board. The number of Stockpiles in each game is equal to the number of players.

Deal two cards from the Market Deck to each player. Players must keep these cards separate from any obtained earlier in the game.

In turn order, each player places both of their two cards in any Stockpile(s) in the game. One card is placed face-up and one card is placed face-down.

Note: The cards can either be placed in the same Stockpile or different Stockpiles. Cards may not be placed in the 4 or 5 player Stockpiles if there are not enough players in the game. Be sure to fan the cards out so everyone can see how many cards are in each Stockpile.

Once all players have added their cards to the Stockpiles, bidding begins in the Demand Phase.

Best for no commissions: Webull

Webull |

| Editor’s rating | 3.67 out of 5 |

| Fees | None for trades Expect fees for data subscriptions and margin borrowing depending on your balance |

| Account minimum | None |

| Consider it if… | You’re after something that’s free to use (for most people) and friendly to active traders |

Why Webull made our list:

Webull is a newer investment platform that has made a splash in the active trading marketplace. It offers completely commission-free investing for stocks, ETFs, and options. You can pay for advanced data subscriptions or margin borrowing, but most users won’t pay any fees when using Webull.

The Webull mobile app is designed for active traders, though passive investors can certainly take advantage as well. There’s a community section of the app to interact with other traders and learn more about different active investing strategies. The interface takes a few minutes to get acquainted with but is manageable.

Best for expert traders: Interactive Brokers

Interactive Brokers |

| Editor’s rating | 4.75 out of 5 |

| Trade Comission Fees | $0 for IBKR Lite; $0.0005 – $0.0035 per share (IBKR Pro) |

| Account minimum | None |

| Consider it if… | You are looking to become a more active trader |

Why Interactive Brokers made our list:

For expert traders looking for a slick, Wall Street-style trading platform, Interactive Brokers is a great choice. Sometimes called IBKR for short, Interactive Brokers offers multiple types of accounts, including ones that work well for retail investors all the way up to professional and institutional investors. It gives investors access to a very wide range of assets including, of course, stocks.

Interactive Brokers’ mobile app, IBKR Mobile, is a fully-functioning investment platform with advanced trading tools in your pocket. Advanced quotes and research contain 50 columns of data in a very similar format to the desktop platform. It’s cutting edge and works best for those with at least some investment experience.

Best for banking and stock trading: Ally Invest

|

| Editor’s rating | 4.08 out of 5 |

| Fees | None |

| Account minimum | $0 ($100 managed accounts) |

| Consider it if… | You want an easy-to-use app paired with excellent checking and savings accounts |

Why Ally made our list:

If you’re interested in a simple and straightforward investment platform that goes hand-in-hand with some of the best checking and savings accounts on the market today, Ally could be the right fit. Ally Invest has no minimum and no recurring fees and shares the same login for accounts with Ally Bank.

With Ally Mobile, you can view your investments and enter stock trades with just a few taps. The app includes basic research and charting, recent news, and the ability to quickly enter a trade. It doesn’t have as many bells and whistles as some stock trading apps, but it covers the basics and makes it easy to trade for a very low cost.

Обучение и безопасность: 2,2/5

Несмотря на то, что на некоторые вопросы даются ответы в Центре поддержки, брокер предлагает блог с обучающими материалами.

Основной его аудиторией являются миллениалы.

В разделе Как торговать предлагается инструкция по основным вопросам, касающимся управления капиталом, управлению рисками, дивидендам и диверсификации портфелей.

Здесь также много материала для скачивания, опросники и видео. В разделе Stockopedia представлен глоссарий, правда не в алфавитном порядке.

Блог также предлагает обучение по тем аспектам, которых нет среди предложений брокера, например, криптовалютам и IPO.

Юзабилити: 3/5

Брокер Stockpile прежде всего уделяет внимание именно своему мобильному приложению. Правда, при этом не забывает и о десктопной версии, имеющей тот же функционал

С учетом того, что продукт нацелен на начинающих трейдеров и молодых инвесторов, здесь достаточно мало аналитических инструментов. При этом, платформа обладает простой навигацией.

Как на мобильной платформе, так и на десктопной выставить ордер можно практически с любого экрана.

В кабинете пользователя представлена информация по эффективности инвестиций.

Меню слева предоставляет доступ к остальному функционалу, включая банковские переводы, покупка или передача подарочных карт, юридические и налоговые документы, история аккаунта и настройки.

Важно отметить, что информация поступает с задержкой в 15 минут и более. Переключаться между таймфреймами нельзя

Информация по часовым или минутным графикам недоступна

Переключаться между таймфреймами нельзя. Информация по часовым или минутным графикам недоступна.

Торговля с брокером: 3,2/5

Брокер предлагает очень простую платформу.

С помощью подарочных карт, пользователи могут делать подарки в виде акций (предусмотрены также специальные аккаунты для подростков и детей до 18 лет).

Соответственно, платформа построена таким образом, чтобы быть как можно проще и доступнее для пользователей.

После входа в аккаунт появляется личный кабинет, где пользователь может видеть текущий баланс и акции, а также общую эффективность.

Ниже расположена быстрая ссылка на страницу с покупкой акций, где пользователь может выбрать акцию или ETF посредством иконок с соответствующими тикерами.

Попасть на эту страницу можно также через меню, расположенное слева.

Пользователи могут отслеживать активы в тренде, инструменты, показывающие лучшие результаты или специфические акции.

По клику на тикер акции, автоматически появляется всплывающее окно, где можно выбрать объем инвестиции.

До открытия сделки необходимо сделать еще пару кликов.

Здесь также предлагается простой график, новости, относящиеся к активу и статистика эффективности, если пользователь кликает на другие вкладки в окне.

В любом случае, всего за пять кликов можно пройти путь от входа в аккаунт до покупки акции.

Stockpile предлагает возможность частичной покупки акций, в отличие от многих брокеров, которые предлагают приобретения целого актива.

Это позволяет инвесторам даже с небольшими аккаунтами покупать акции таких компаний, как Amazon или Alphabet.

Frequently asked questions

How did we choose the best stock trading apps?

The best stock trading apps come from brokerages that offer low-fee accounts and feature-filled mobile trading platforms. We also considered pricing, available investments, account types, and investment research resources in the apps.

What are brokerage accounts?

A brokerage account is a financial account that gives you access to buy, sell, and hold stocks and other supported investment assets. Like a bank account, you can deposit and withdraw cash. But unlike a bank account, you can use your cash balance to buy stocks, ETFs, mutual funds, options, futures, forex, bonds, and other assets.

How do brokerage accounts work?

Brokerage accounts are connected to the US financial system. You can generally add funds using your brokerage’s mobile app by check. You can also add or withdraw using electronic funds transfers, wire transfers, and other supported methods from your brokerage.

In the US, brokerage accounts are regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulation Authority (FINRA). While investment assets can lose value, accounts are insured by the US government through the Securities Investor Protection Corporation (SIPC).

Who should use a brokerage account?

You can’t buy and own stocks and other assets without a brokerage account, so anyone who wants to invest should get one. If you’re heavily in debt, you may want to pay off high-interest debts before funnelling too much of your budget into the stock market.

Remember that while most people buy stocks with the intention of making money, stocks and other investments can go down in value. Make sure you learn about what you’re investing in so you understand the risks and potential return.

How much should a brokerage account cost?

In the 2020s, brokerage accounts should be free for the most part. You should be able to open and maintain an account with no minimum balance requirement, no recurring fees, and no activity requirements, with a few exceptions for active traders and managed portfolios.

In 2019, most brokerages got rid of commissions for trading stocks and ETFs, as well as base fees for options. This makes investing accessible to just about anyone.

How do I choose an online brokerage?

Every investor has different goals and preferences. You should pick a brokerage that offers platforms and tools that are comfortable to you and products that align with your investment style. Fees can take a huge portion out of your investment gains, so always look at commissions, fees, and pricing for any activity you may need so you don’t get surprised with an unexpected charge.

Что следует знать о работе с брокером Stockpile

Брокер Stockpile предлагает уникальный функционал в сравнении с другими компаниями, работающими в этой индустрии.

Основное внимание уделяется именно неопытным инвесторам, которые могут получить базовые знания по фондовому рынку. Платформа брокера Stockpile не подходит опытным трейдерам или тем, кто находится в поиске компаний, предлагающих широкий спектр активов

Платформа брокера Stockpile не подходит опытным трейдерам или тем, кто находится в поиске компаний, предлагающих широкий спектр активов.

Вместо этого, брокер предлагает детям, подросткам, а также молодым людям погрузиться в мир инвестиций в доступной и удобной форме.

Благодаря наличию подарочных сертификатов и очень низкой комиссии за транзакции, брокер позволяет пользователям обучиться финансовой грамоте вне зависимости от их возраста или объема инвестиций.

Other brokerages we considered

- E-Trade offers a great stock trading platform for a wide range of investors. It was recently acquired by Morgan Stanley.

- Robinhood: Robinhood is a brokerage service offering commission-free trades on stocks, ETFs, and options. The investing platform also offers fractional shares and specialty investment products like cryptocurrencies, but its investment selection is limited.

Tastyworks: Tastyworks is best for traders who are more interested in active options trading.

Firstrade: Firstrade offers commission-free trades for most assets, but its trading apps are not quite as strong as some others.

Public: Public is best for traders looking to learn how to trade from others. It includes “public” trading where you can view what others are doing to learn more and improve your trading skills.

Мобильные технологии: 2,7/5

Мобильное приложение брокера Stockpile работает на iOS и Android. Здесь есть несколько функциональных особенностей, которые недоступны в десктопных платформах.

Наиболее полезной является список.

В то время как десктопная платформа предлагает пользователям ограниченную информацию по доступным тикерам, мобильная позволяет добавлять тикеры в списки, которые можно просматривать в кабинете после входа в аккаунт.

Кстати, здесь же доступны не только списки, но и новости относительно активов инвестора. На десктопной платформе предлагаются новости по каждому тикеру в отдельном окне.

Десктопная платформа работает без двухфакторной авторизации. Мобильное приложение предлагает функцию входа по отпечатку пальца.

Selling Phase

The Selling Phase gives players an opportunity to sell any shares of stock that they currently own. They should use the knowledge from the Information Phase to know if and what stocks to sell.

Selling Phase Steps

In turn order, players may sell any number of stocks that they have obtained by placing them face-up in the discard pile and collecting money from the bank equal to the stock’s current value for each stock.

Note: Stocks sold from a player’s Split Portfolio pay two times the value of the stock. Players may alternatively move a stock from their Split Portfolio back to their regular Stock Portfolio to receive one times the current value of a stock from the bank.

This represents selling only one stock from a split stock. See Movement Phase: Stock Splits for more information on split stocks.

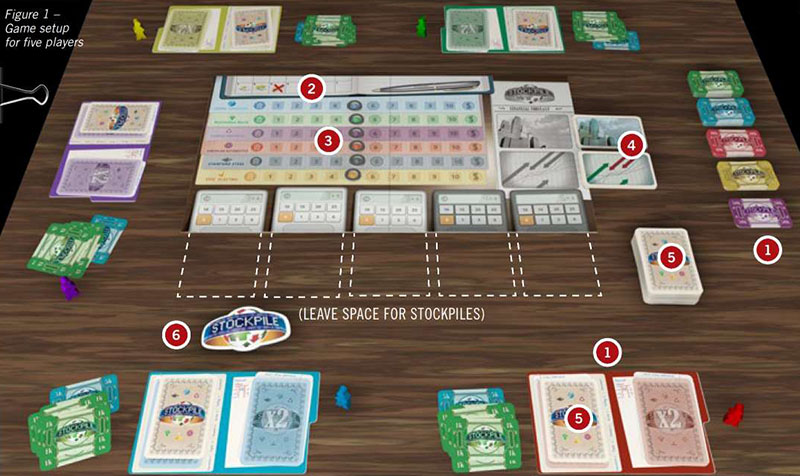

Setup

1 Pass out a Bidding Meeple, Player Board, and $20,000 in Currency Cards (three $5K and five $1K bills) to each player. Place the remaining currency cards next to the board.

2 Place the Turn Marker on the calendar space on the game board that corresponds to the number of players.

3 Place a Stock Ticker on the starting values of each stock, indicated by darkened circles.

4 Shuffle and place the Company Cards and Forecast Cards next to the board in separate piles.

5 Pull out one of each of the six different stock cards from the Market Deck and deal one to each player. Each player places this stock face down in the Stock Portfolio spot of the player board. This stock functions normally as other stock obtained during the game.

Place any extra cards back in the Market Deck, shuffle and place it next to the board face-down.

6 The game begins with the player who paid the most for their previous meal. Give him/her the First Player Token.

Best for long-term investing: Fidelity

Fidelity |

| Editor’s rating | 4.79 out of 5 |

| Trade Comission Fees | None |

| Account minimum | None |

| Consider it if… | You’re focused on long-term investing and retirement |

Why Fidelity made our list:

Fidelity offers a wide range of accounts and investments that could meet the needs of virtually any investor, but it stands out as a great choice for stock market inventors looking to buy and hold for long-term goals like retirement. It offers a wide range of investing products, including fractional shares.

In addition to common tools that allow you to research and trade stocks, Fidelity offers apps and tools to help you reach retirement goals and other long-term plans. For example, the new Fidelity Spire app is a goal-oriented app that encourages good saving and investing habits to reach the goals you’ve specified.

Fidelity is best for beginners as well as experienced, long-term, passive investors.

Movement Phase

During the Movement Phase, stock values move according to the Company and Forecast Cards dealt during the Information Phase.

Movement Phase Steps

1. In turn order, players reveal their Company Cards and Forecast Cards and move the stock values accordingly.

2. Move the remaining stock values according to the face-up and face-down pairs of Company Cards and Forecast Cards on top of and next to the board. All stocks will be affected every round.

3. The Forecast Card labeled “$$” means a company pays out dividends. The stock value does not change. Instead, each player immediately receives $2,000 for each share of that company’s stock in his/her portfolio.

Note: A player will receive twice the dividends for stock in his/her Split Portfolio. A player must reveal shares of stock to receive the dividends for it. He/she may choose not to collect on some or all of that stock to avoid revealing how many shares they have.

Stock Splits

If a stock’s value ever increases to more than 10, the stock splits. A stock split effectively doubles your existing shares for that stock.

When a stock splits, all players who have stock of that type in their portfolio will reveal it and move it to their Split Portfolio face-down.

If the increase causes the stock’s value to land exactly on the Stock Split space, then the value of the stock returns to 6. If the stock’s increase would move the value further than the Stock Split space, reset the value of the stock to 6 and continue to increase the stock’s value.

Any new stock obtained after the stock split goes in a player’s regular Stock Portfolio, not the Split Portfolio.

If a player already owns a stock in his Split Portfolio and that stock splits again later in the game, then that player receives $10,000 in Currency Cards for each Stock Card of that type in their Split Portfolio. The stock then remains in the Split Portfolio.

Bankruptcy

If a stock’s value ever moves below 1 on a turn, it immediately goes bankrupt.

All players discard all stock of that kind that they own, including any stocks in their Split Portfolio. Return the stock’s price to the starting value of 5.

The experts’ advice on choosing the best stock trading app for you

We interviewed the following four investing experts to see what they had to say about stock trading apps:

- Brian Fry, CFP, founder at Safe Landing Financial

- Charlotte Geletka, CFP, CRPC, managing partner at Silver Penny Financial Planning

- Kaysian Gordon, MBA, CFP, CDFA, CPA, wealth manager at Clarus Group

- Rickie Houston, wealth-building reporter, Personal Finance Insider

What are the advantages of using an investing app to trade stocks?

Brian Fry, CFP:

Of course, there’s going to be different levels of what’s offered through these different apps. Some of them may offer light financial planning, or low-cost or transparent investment options.

drilling down and finding the app that’s going to best provide that transparency and best provide the confidence that one’s looking for in planning one’s financial future.

Charlotte Geletka, CFP, CRPC:

Investing apps

make it easier than it has ever been for the individual to trade stocks right on your phone.

Kaysian Gordon, MBA, CFP, CDFA, CPA:

is being able to have the research you need to make that decision. Look for the app that’s going to give you enough of the information that you need to be able to make a wise decision when you’re trading stocks.

Rickie Houston, Personal Finance Insider:

Many investing apps offer commission-free trading, low account minimums, and educational resources. This makes them an attractive option for both beginner investors and experienced traders.

What are the disadvantages of using an investing app to trade stocks?

Brian Fry, CFP:

When you have free trades, you have to realize that these investment companies are making their money one way or another. So just because it’s free doesn’t mean it’s better.

Cost is definitely something, but when you’re looking at free trades versus $5 trades or $10 trades, to me it’s all irrelevant. It’s really about what’s going to be the best user experience? What’s going to empower an investor to feel confident?

Charlotte Geletka, CFP, CRPC:

The disadvantage is that encourages impulse investing. Numerous studies show that when the retail investor engages in impulse investing and frequent trading he or she ends up with lower than average returns.

Kaysian Gordon, MBA, CFP, CDFA, CPA:

You want to make sure you all of your eggs in one basket. I can’t stress that enough no matter how good you think a company is.

Rickie Houston, Personal Finance Insider:

Most stock trading apps are mainly tailored toward hands-on investors. However, if you’re more of a hands-off investor, many of these apps also offer an automated account option.

Is there any other advice you’d offer someone who’s considering using a stock trading app?

Brian Fry, CFP:

Most investment platforms offer similar benefits. Choose the platform that best helps you stay on track and identify progress towards your financial goals.

Charlotte Geletka, CFP, CRPC:

Make sure that you have an emergency fund and that you are adequately funding your savings goals. Use your extra money for trading apps.

Kaysian Gordon, MBA, CFP, CDFA, CPA:

Don’t put too much money in one stock that, if you lose the money, you’re going to be hurting.

Rickie Houston, Personal Finance Insider:

Pick a few of your favorite stock trading apps and weigh the pros and cons of each platform. FAQ sections can be extremely helpful when you’re comparing fees, features, and more.

Demand Phase

The Demand Phase is when players acquire a Stockpile built during the Supply Phase. The Bidding Track represents the demand or the value to be paid in money for the corresponding Stockpile at the end of the phase.

Demand Phase Steps

In turn order, each player places his/her Bidding Meeple on an open number of any Bidding Track they choose, including those tracks with bids already on them so long as the bid increases.

Note: A player may not bid more money than they currently have. How much money a player has is public knowledge.

If, and only if, a player is outbid by another player (i.e., another player placed his/her Bidding Meeple farther along the same Bidding Track), then the outbid player picks up their Bidding Meeple and re-bids on their next turn.

Note: The re-bid occurs only after all players have had the chance to bid once. If multiple players outbid each other, re-bids proceed in clockwise order. The re-bid may be placed on the same Bidding Track or a different one.

If there are no further open spots on a Bidding Track, then that Bidding Track is locked: the maximum bid is $25,000. You cannot underbid or match another player’s bid.

Bidding continues until all Bidding Tracks have one Bidding Meeple on it.

Players pay the bank the amount of their bid, collect their Bidding Meeple, and pick up all of the cards in the Stockpile they purchased.

Note: A player may end up bidding and paying $0 for a Stockpile.

If a player’s Stockpile contained a Trading Fee Card, the player pays the bank the amount listed. Once paid, Trading Fee Cards are placed face-up in the discard pile next to the Market Deck.

Note: If players do not have the funds to pay for the trading fee, they must keep the card, placing it face-up in front of them. Any trading fees held this way must be paid immediately upon receiving enough money.

Place the remaining cards obtained in the Stock Portfolio section of the Player Board face-down.

Note: Stock cards obtained during the game should be kept secret from other players. A player may look at which stocks he/she has at any time.